호주 RBA 기준금리동결-20200707

FOHUNTERS™

FOHUNTERS™

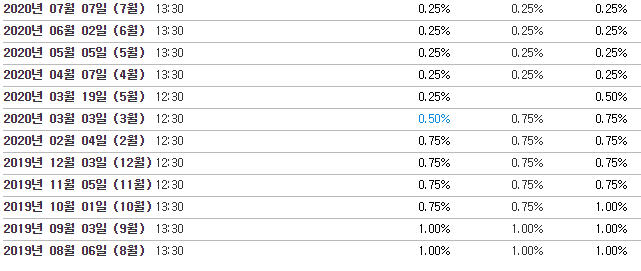

| 기준금리 | 0.25% |

|---|

오늘 낮에 발표된 호주기준금리입니다. 전월과 동일한 0.25%로 동결

Statement by Philip Lowe, Governor: Monetary Policy Decision

At its meeting today, the Board decided to maintain the current policy settings, including the targets for the cash rate and the yield on 3-year Australian Government bonds of 25 basis points.

The global economy has experienced a severe downturn as countries seek to contain the coronavirus. Many people have lost their jobs and there has been a sharp rise in unemployment. Leading indicators have generally picked up recently, suggesting the worst of the global economic contraction has now passed. Despite this, the outlook remains uncertain and the recovery is expected to be bumpy and will depend upon containment of the coronavirus. Over the past month, infection rates have declined in many countries, but they are still very high and rising in others.

Globally, conditions in financial markets have improved. Volatility has declined and there have been large raisings of both debt and equity. The prices of many assets have risen substantially despite the high level of uncertainty about the economic outlook. Bond yields remain at historically low levels.

In Australia, the government bond markets are operating effectively and the yield on 3-year Australian Government Securities (AGS) is at the target of around 25 basis points. Given these developments, the Bank has not purchased government bonds for some time, with total purchases to date of around $50 billion. The Bank is prepared to scale-up its bond purchases again and will do whatever is necessary to ensure bond markets remain functional and to achieve the yield target for 3-year AGS. The yield target will remain in place until progress is being made towards the goals for full employment and inflation.

The Bank's market operations are continuing to support a high level of liquidity in the Australian financial system. Authorised deposit-taking institutions are continuing to draw on the Term Funding Facility, with total drawings to date of around $15 billion. Further use of this facility is expected over coming months.

The Australian economy is going through a very difficult period and is experiencing the biggest contraction since the 1930s. Since March, an unprecedented 800,000 people have lost their jobs, with many others retaining their job only because of government and other support programs. Conditions have, however, stabilised recently and the downturn has been less severe than earlier expected. While total hours worked in Australia continued to decline in May, the decline was considerably smaller than in April and less than previously thought likely. There has also been a pick-up in retail spending in response to the decline in infections and the easing of restrictions in most of the country.

Notwithstanding the signs of a gradual improvement, the nature and speed of the economic recovery remains highly uncertain. Uncertainty about the health situation and the future strength of the economy is making many households and businesses cautious, and this is affecting consumption and investment plans. The pandemic is also prompting many firms to reconsider their business models. As some businesses rehire workers as demand returns, others are restructuring their operations.

The substantial, coordinated and unprecedented easing of fiscal and monetary policy in Australia is helping the economy through this difficult period. It is likely that fiscal and monetary support will be required for some time.

The Board is committed to do what it can to support jobs, incomes and businesses and to make sure that Australia is well placed for the recovery. Its actions are keeping funding costs low and supporting the supply of credit to households and businesses. This accommodative approach will be maintained as long as it is required. The Board will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band.

원문링크 : https://www.rba.gov.au/media-releases/2020/mr-20-17.html